Women-owned businesses have been on the rise, but do you know by how much? The simplified answer: a significant amount, especially in the past 5 years. So much so that in 2018 women were employing roughly 9 million individuals in the U.S. and generating over $1.7 trillion dollars in annual revenues, according to American Express in their 2017 State of Women-Owned Businesses Report.

So, what does this mean for financial and investment advisors? It means there has been an obvious shift in the larger landscape of entrepreneurialism, creating more significant business and revenue opportunities for those searching for new prospects. Women-owned businesses are now an obvious target.

Not that long ago, women-owned businesses were mostly made up of solopreneurs operating at relatively lower revenue streams than their male counterparts. These lower revenue streams subsequently resulted in lower saving rates as well as investing capabilities. Additionally, women run enterprises did not typically have employees beyond the owner. And let’s face it, we all know that higher revenues and more employees equals greater opportunity for financial and investment advisors.

However, as current data reveals, things have changed. In fact, women leaders are continuing to take the business world by storm. For example, over the last decade new business owners had a growth rate of 44%, whereas women-owned businesses grew by 114%. And as it sits right now, 39% of all U.S. firms are women-owned.

Now, here’s the interesting bit. Leading Retirement Solutions introduced a national study in 2017 to identify specific trends and habits of women in business and their retirement.

Highlights of Our 2017 Retirement Savings Gap Study: (For updated results check out our 2018 study here)

- We discovered that only about 50% of women business owners claim to be confident in reaching their retirement goals.

- More than 75% lacked the consistent saving habits and guidance required to build a quality retirement.

- The majority of women business owners are beginning to gain confidence in their retirement as they seek out professional sources for financial advice.

Putting it all together we can easily see that here we have an increasing population of women business leaders that are lacking in experience and guidance in preparing for a quality retirement but are seeking out professional guidance. So, if you haven’t already done so, begin retooling your outreach strategies for new prospects to incorporate women business owners.

How can you engage with this growing demographic? Well, it begins with identifying and engaging with the right prospects, and here are three ways to do it:

Acquire Prospecting Lists

There are several ways to gather lists of women-owned businesses. In fact, there are specific certifications for women-owned businesses at both the state and national level that allows them to compete for government contracts. Which if we know anything about government contracts is that the resulting revenues streams are generally high. This certification also makes their information readily available on varying (government) websites.

There are even some states, like Washington, that maintain a public database on business owners and their varying segments that is easily accessible here. If you can, identify women-owned businesses with annual revenues streams over $1 million, or if they have employees beyond the owners as this would indicate higher revenue streams and thus higher investing potential.

Target Specific Industries

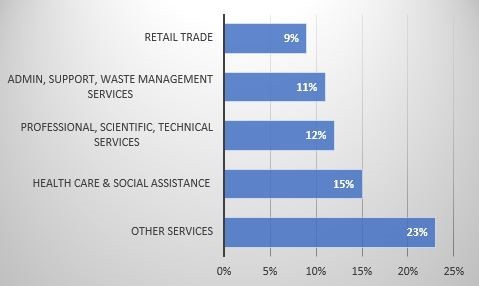

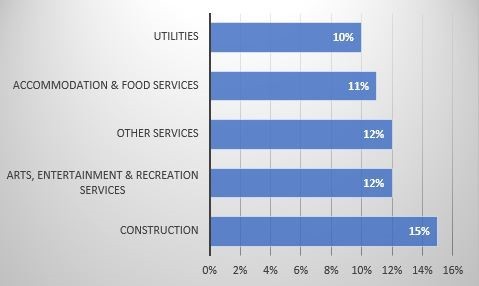

The American Express Report mentioned above also breaks down women-owned businesses by industries where niche marketing/outreach can occur, but also it details out the largest as well as emerging industries for women business owners.

Top 5 industries for women-owned businesses

Top 5 industries where women-owned businesses grew the most

Associate with Women Organizations

Another thing to consider is to identify and begin associating with specific women associations. There are many women organizations out there and all with their own inspiring aspirations, but they may not necessarily be or lead to a pool of prospects you’re searching for. So how do you know which associations to target?

A good start is to identify women business associations that require a minimal level of annual revenue from one’s business in order to become a member. Such as the Women Presidents Organization which requires a business to make a minimum of $1 million in annual revenue before the owner is invited into this prestigious organization. Another great association to consider is Vistage. Generally, a woman who participates in Vistage owns a business with roughly $5 million in annual revenues. Getting the picture?

There are also several ways you can associate with these organizations. The best way and most obvious is to start networking with them any way you can, but if you want to get your foot in the door a little faster think about ways to support them or even becoming a sponsor of the association itself or co-sponsor one of their events. Of course, finding an organization that aligns with your own company’s values will always prove to be the best fit.

Leading Retirement Solutions is a woman owned and operated retirement plan compliance and administration company, headquartered in Seattle, WA with clients in all 50 states. We are a USWCC and OMWBE Women Owned and Certified and a member in good standing with ASPPA. We help financial and investment advisors and their clients meet vendor diversity requirements and support hundreds of women led businesses and their owners, across the country.

For more tips and information regarding retirement plans, contact us.